Contents

The proceeds of your home sale will be used to pay off your mortgage, but it’s likely that the payoff. Use a calculator to.

How much home can I afford? Mortgage Affordability Calculator. The second step in buying a house is determining your budget. This Mortgage affordability calculator helps answer the question ‘How much mortgage can I qualify for?’ and ‘How much home can I afford?’.You can use the House Payment Calculator function – calculate for the ‘total monthly payment’ and it will calculate the.

How much home can I afford? Mortgage Affordability Calculator. The second step in buying a house is determining your budget. This Mortgage affordability calculator helps answer the question ‘How much mortgage can I qualify for?’ and ‘How much home can I afford?’.You can use the House Payment Calculator function – calculate for the ‘total monthly payment’ and it will calculate the.

Use our free mortgage calculator to quickly estimate what your new home will cost. Includes taxes, insurance, PMI and the latest mortgage rates.

Find out how much you can afford. Your mortgage payment is just one of the expenses of buying a home. You’ll face a number of one-time fees, as well as new monthly and annual costs. The table below describes some of the fees and expenses you can expect to pay.

But if you’ve done the math, you may think you can’t afford a home. about fluctuating interest rates. 15-Year Mortgage vs..

What Kind House Can I Afford Estimate the home price you can afford by inputting your monthly income, expenses and specified mortgage rate. Adjust the loan terms from 15-, 20- and 30-year mortgages and see your estimated home price, loan amount, down payment and monthly payments change.

To determine how much house you can afford, use this home affordability calculator to get an estimate of the property price you can afford based upon your income and debt profile. Generally, lenders cap the maximum monthly housing allowance (including taxes and insurance) to lesser of Front End Ratio (28% usually) and Back End Ratio (36% usually).

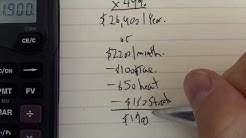

Salary Vs Mortgage Payment Income required for mortgage calculator. calculators provided by Bankrate.com At 4.5% your required annual income is $43,430 Maximum monthly payment (PITI) $1,013.37 Purchase price: price: $0k $200k $500k $1mk 0k 0k m Down payment: $0k $200k 0k m loan amount: 0,000.00 The total loan amount you are looking to qualify for.Reddit First Time Home Buyer Tips A first time home buyer should step outside and explore the home’s neighborhood to make sure it’s a good fit for their lifestyle. Not doing so could be a big mistake. Purchasing a home without spending quality time in the neighborhood or meeting the neighbors, may end in a serious case of buyer’s remorse.

Your total annual income can impact how much mortgage you can afford. If you’re buying a home with other people, include their incomes, too. Gross household income in dollars. Gross household income is the total income, before deductions, for all people who live at the same address and are co.

How Much House Can You Afford to purchase? published june 11, 2012. You must insure your property to obtain a mortgage. You can get an estimate of insurance costs from an insurance agent or.

Required Annual Income: — The sum of the monthly mortgage, monthly tax and other monthly debt payments must be less than 43% of your gross (pre-taxes) monthly salary. DISCLAIMER: The figures above are based upon current fha program guidelines. FHA requires a 3.5% down payment as well as an upfront and monthly mortgage insurance in many cases.